Welcome Money Stuff readers!

Yesterday, the inimitable Matt Levine gave Money Puff a shoutout in his newsletter. Today, I have a whole lot of new subscribers. Welcome!

What can you expect here? A daily discussion on the cannabis industry, with a financial lens. You can reply to this email or leave a comment with your opinions, perspectives, personal experiences, gripes — I look forward to hearing from you!

I know the Money Stuff community is incredible, and I hope to build something similar here. So, without further ado, let’s get to everyone’s favorite topic…

Taxes!

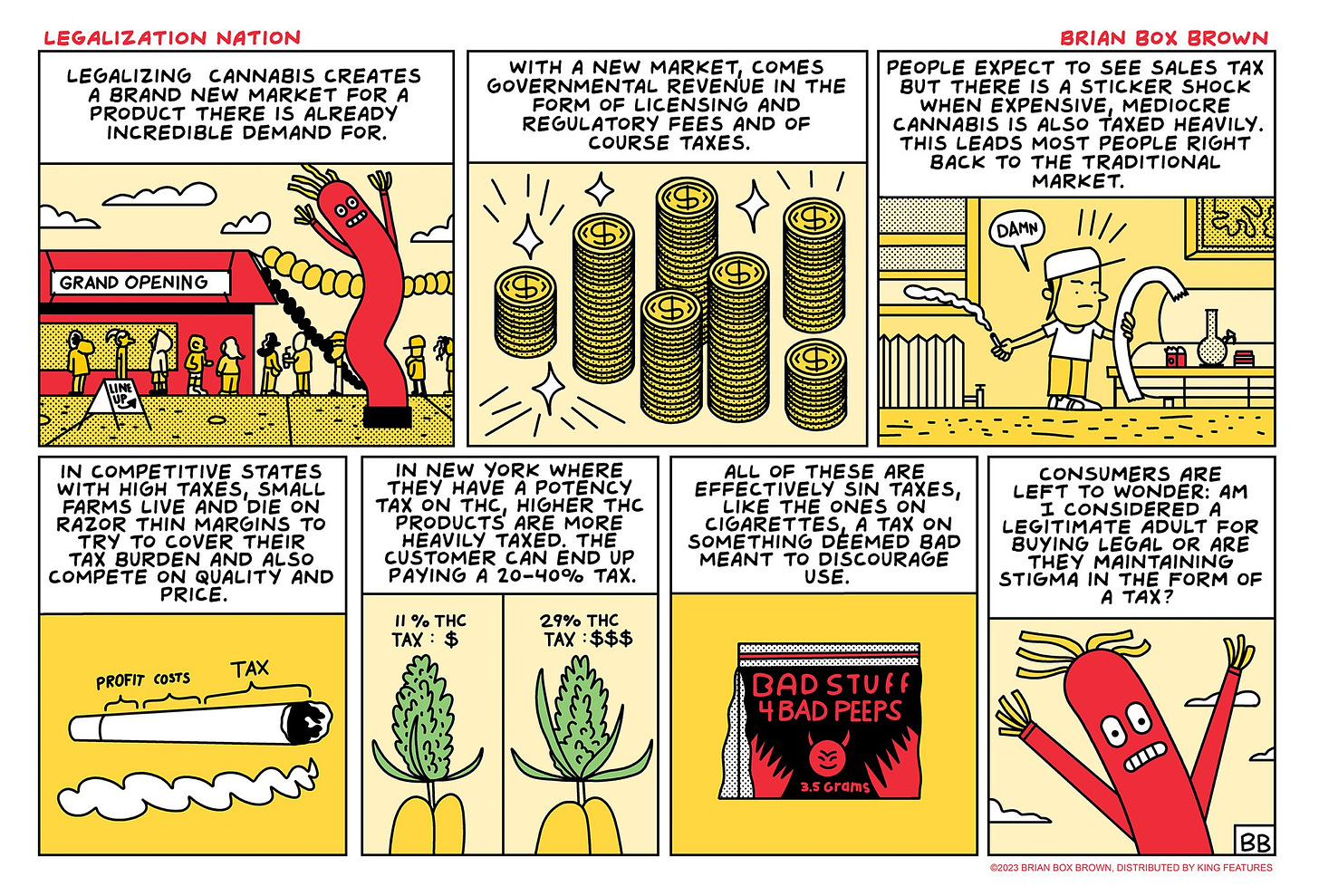

Here’s Brian Box Brown’s comic, “Legalization Nation,” with a great explainer on exploitative cannabis taxes:

There are a few different concepts here — and taxes are probably the biggest problem that cannabis companies face today — so I want to break this down further.

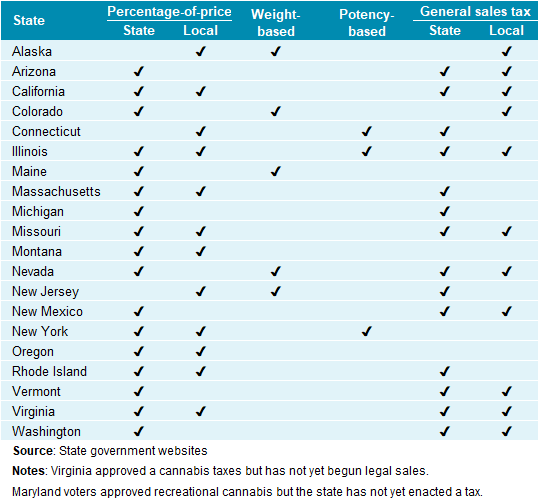

Broadly speaking, there are three types of taxes: federal, state, and local. State and local taxes end up getting a lot of attention because they are often, as the comic aptly puts it, ‘sin taxes,’ above and beyond the regular sales taxes that consumers pay on every good they buy. For a cannabis company, these are known as ‘excise taxes,’ and can get as high as 37% (!) in Washington. Here’s the Urban Institute with a helpful table with the 19 states that have cannabis taxes (Virginia approved cannabis taxes but has not yet begun adult-use sales):

These taxes are paid by the consumer. I was raised in an Irish-Catholic household, so this especially hurts. I already know I’m a damned sinner! Do you really have to tax me for it?

But what really gives cannabis owners the howling fantods is the bugaboo of the federal tax system: Section 280E. Bet you didn’t know that the tax code had specific language for businesses that consist of ‘trafficking in controlled substances.’ Even the cartels have tax bills from Uncle Sam.

What does Section 280E mean for cannabis companies? Basically, a company has two kinds of expenses: cost of goods sold (COGS) and operating expenses. For a cannabis retailer, COGS would be the cost of inventory, and operating expenses would be things like employee costs, rent, marketing, etc. A normal business owner will pay taxes on their net income, or what’s left over after COGS and operating expenses. For a lot of businesses — particularly tech businesses — this will be zero or even negative; they have no tax liability and can sometimes even make use of a new asset to reduce future liabilities.

For a cannabis company, the federal government does not recognize any costs beyond the cost of goods sold. So a cannabis business owner has to pay taxes on what they’ve “earned” after deducting COGS, or their gross profit. Do they actually have this money? No! Of course not — they still had to pay all those operating expenses, and are probably operating at a loss. So, where a normal business would sensibly not be taxed, a cannabis company quickly racks up massive tax bills that they are not able to pay.1

Is that unfair? Absolutely! How anyone can expect a legal cannabis business to ever make money under this kind of tax regime is beyond the understanding of this newsletter. Expect ‘People are worried about cannabis taxes’ to become a recurring section.2

Narc of the week

While I had fun taking a swing at last week’s narc, this week’s felt like punching down. I know I speak for many when I say I’m shocked and disappointed at the latest faction trying to restrict the cannabis market: dogs.

Say it ain’t so! Specifically, I’m talking about this genuinely hilarious video of a Minnesota state senator making an utterly incoherent argument against legalization:

Maybe he was drunk. And elsewhere, dogs are apparently getting sick from eating discarded joints on the ground. You can always count on the New York Times to bring you the news that people really care about, like that dog’s shouldn’t be allowed to eat random shit they find in the street. Who knew?

Other Puff

Maryland’s New Cannabis Regulations Are Problematic for Stakeholders, Investors

Indiana lawmakers hear, but don’t vote on, bill decriminalizing marijuana

Pa. Department of Health sues to keep medical marijuana program data secret

Florida Medical Marijuana Patient Count Increases 71% in Two Years

Deceased farmer’s estate not entitled to Florida marijuana license, judge rules

Illinois Governor Says Marijuana Legalization Has Created Over 30,000 Jobs In The State Since 2020

Wisconsin gov reintroduces marijuana legalization in budget proposal

Halo Infusions Announces Plans for Arizona’s Largest Dedicated Cannabis Kitchen

Lucy Files with Health Canada To Manufacture Cocaine, Heroin

And many don’t! Anecdotally, I know there are a lot of cannabis companies out there that are simply ignoring their federal tax bill; the IRS imposes something like a 6% annual penalty on unpaid taxes, which is less than their cost of capital. (This is not legal or tax advice!)

In much the same way that People are worried about bond market liquidity.

For the win:

"I was raised in an Irish-Catholic household, so this especially hurts. I already know I’m a damned sinner!"