Brand value

If you’re at all aware of weed culture, you know Wiz Khalifa. He’s the Snoop for younger Millennials, rapping and putting out lots of content about his love for weed. He also has his own brand, Khalifa Kush, that in turn has an exclusive partnership with MSO Trulieve.

Last week, Wiz responded to a tweet that referred to his weed as ‘overpriced rapper mids’:

There’s a common axiom, found everywhere from finance to fantasy, that can be applied to cannabis in the form, ‘if your weed is actually bomb, you wouldn’t have to tweet it.’1 If Wiz wants to sell more Khalifa Kush, he should focus on smoking what he sells.

Of course, folks are still going to be pissed off because of where Wiz sells his weed. The brand issue is presumably more about Trulieve than it is about the quality of bud. The tweeter used the term ‘rapper mids,’ but really what they mean is ‘corporate mids.’ Trulieve is a big corporate MSO, and their weed will leave a bad taste in the mouth of cannabis connoisseurs and legacy industry insiders no matter what brand they’re smoking.

There are legitimate reasons for this disdain. For one, companies like Trulieve throw money behind bills that ensure they will have first-mover advantage in new markets. They also support the continued criminalization of home grow, claiming it will eat away at legal market profits and facilitate expansion of the ‘illicit’ market. Here’s the Miami New Times from last August on the Florida adult-use bill that has the support of Trulieve:

The fact that the proposal contains no provision to broaden the rarefied ranks of existing dispensaries, coupled with the lack of a clause that would allow Floridians to grow their own marijuana, virtually guaranteed that the initiative would be met with skepticism, if not outrage, from those who want to see cannabis legalized for recreational use.

"It's keeping almost everything exactly the same as what's going on in the medical market, which we've been extremely critical of," cannabis cartoonist Brian Brown tells New Times. "It's hostile to small business. All this initiative really does is allow existing operators like Trulieve that already are in a limited-competition state to also sell to tourists and other people coming into Florida."

Brian Brown also has a great cartoon on home grow law, hilariously featuring Chris Christie:

Trulieve is also known for treating workers poorly, with a track record that includes a death at their Massachusetts processing facility. The Young Jurks has been covering the company’s controversies closely:

The question becomes, is there negative brand value associated with corporate cannabis MSOs?

It’s no secret that the big MSOs want to be consumer packaged goods (CPG) companies more than they want to be retailers. A good exit — following federal legalization — would be an acquisition by Coke rather than Walmart. A lot of the value in a CPG company comes from their brand; you’re often selling a commoditized product in a competitive marketplace, which means you need to differentiate with marketing and distribution.

That’s where Wiz comes in for Trulieve; he’s essentially a paid spokesperson. That’s one part of the brand value equation, called brand equity, the likelihood that a customer will choose your brand over another due to known associations. Trulieve’s brand equity appears to be low, since their paid spokesperson cannot overcome the negative associations with the rest of the business, regardless of the quality of the weed.

The other big component of a CPG brand’s value is their distribution. It doesn’t quite matter how much equity you have in the brand if you can’t get it to consumers. Here, you can think of valuing MSOs more on franchise value, or their licenses to grow and sell cannabis in legal markets. This is where most of the value currently lies for MSOs, since there are a limited number of licenses.

Is there a lot of value in an MSO franchise? Ask Silicon Valley Bank or Credit Suisse how much the market valued their banking franchises. Spoiler alert: it was a puff of smoke as soon as depositors’ money was in question. It seems likely that the market would think about cannabis franchise value in a similar way, particularly after federal legalization.

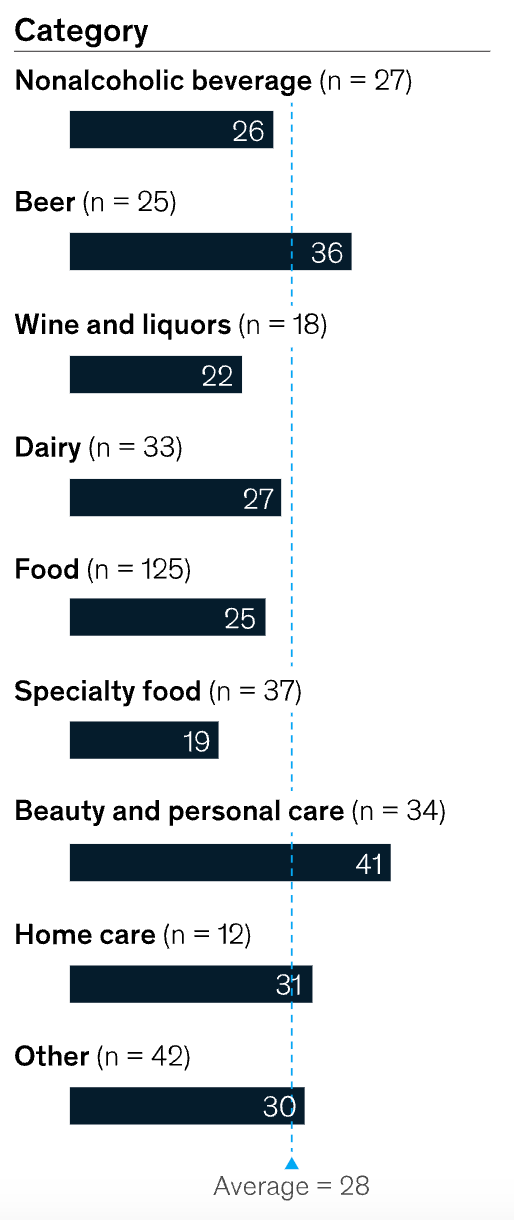

Is there hope for overpriced rapper mids? Absolutely! We’ve talked before about ‘mids’ as the beer of cannabis; beer is one CPG category where empirically brands can extract a lot of brand value. Here’s some data from McKinsey that shows the share of ‘accretive growers’ (companies with EBIT margin expansion above the relevant category median and real organic growth above the sample average) in different CPG categories:

There’s still a lot of value in mids, but you have to make sure negative brand equity does not sink the ship.

The NBA

Speaking of brands, start getting excited for ‘King Kush’ or whatever other brand LeBron decides to start:

I just hope NBA players are reading Money Puff and understand the risk of partnering with MSOs.

Other Puff

New York Adds Another 99 Cannabis Retailers, Bringing Total Licensed to 165

Germany imports record amount of marijuana, but growth slows

Patrick McKenzie’s great piece ‘Banking in very uncertain times’ pointed me to the Game of Thrones reference.