SPACs!

Let me start by saying that it feels great to be writing about SPACs in a financial newsletter. Mama, I’ve made it.1

Since Matt Levine and others have laid tremendous groundwork in the understanding of the SPAC boom (and subsequent crash), I won’t go into too much detail here about their mechanics or structure.2 All you really need to know is a SPAC is a vehicle for a private company to become a public company.3 It’s sort of like an IPO, but with a ton of financial engineering.4

And there were some cannabis SPACs! And they haven’t done great! Here’s a table from August with some SPACs and their returns (source):

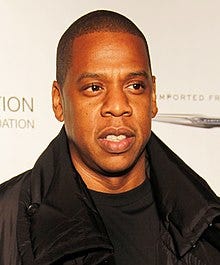

One of the SPACs was called Subversive Capital Acquisition Corp. (which is a sweet name). It acquired California's direct-to-consumer platform Caliva, and cannabis and hemp manufacturer, Left Coast Ventures, to form a new vertically-integrated cannabis company, The Parent Company. They also partnered with Jay-Z and Roc Nation on the deal, and they gave Jay-Z a made-up title called “Chief Visionary Officer.” He’s not a businessman; he’s a business, man. You can read the press release here.

It didn’t go great for The Parent Company. The stock went down a lot, they announced a restructuring in January, and now they’ve been acquired by a competitor.

The Parent Company was explicit in its social equity mission. From Jay-Z in the initial SPAC press release:

The end of cannabis prohibition is here, and The Parent Company will lead the charge to a more expansive and inclusive cannabis industry. We are paving a path forward for a legacy rooted in dignity, justice, care, and consistency. The brands we build will redefine growth, social impact, and social equity.

In the days since the announcement, some have called the merger an indictment of the social equity model of cannabis brands and companies. But I don’t think that’s right? There may be problems with social equity initiatives or programs, but they do not include the problems of a SPAC; those are unfortunately everyone’s problems.

RAW, RAW, RAW

Here’s Will Yakowicz from Forbes with more on the weirdo that founded RAW, the company recently exposed for massive fraud:

A longtime former employee, who declines to use his name for fear of retribution, says he ended up leaving HBI because of Kesselman’s habit of bending the truth. “[He’s] pretty much a pathological liar,” the ex-employee says. “He is very good at training himself—if you tell the story enough times in your head, you’re going to believe it and it'll become the truth in your mind.”

One of the most bizarre revelations to come out in the lawsuit is that HBI had been championing its charitable organization known as the Raw Foundation. There is, however, no nonprofit listed with that name, according to a public database for registered 501 (c) (3)s, and HBI agreed to stop advertising its foundation. In a statement, the company explained that it “may have created the impression that we ourselves were a charity. We are not a charity.”

I hope this newsletter never creates the impression that it is a charity. We are not a charity.

Other Puff

New York’s Emerging Cannabis Industry Plans to Find 63,000 Workers

Marijuana Testing And Labor Shortages Affect Trucking Industry, New Report Finds

California county’s cannabis industry on ‘the brink of irreversible failure’

Delays in NY’s cannabis roll out hurt plans for small business investors

Forian exits marijuana industry with $30 million sale of BioTrack to Alleaves

SNDL Lays Off Alberta Grow Employees, Focuses on Premium, Alcohol Brands

Crested River Cannabis Company Launches Cannabis-Dedicated Beverage Manufacturing Line in Minnesota

California Cannabis Prisoner Luke Scarmazzo Released from Federal Prison

Leafbuyer Technologies Q2 FY22 Revenue Grows 45% YoY, First Profitable Quarter As Public Company

Aurora Cannabis Prepares For Global Legalization Wave, Analyst's Thoughts Post Q2 Earnings

You may remember a SPAC discussion from the edition of Money Stuff where Matt gave Puff a shoutout. We were such a young, fresh-faced newsletter back then. Ah, memories.

Not to toot my own horn, but I was an investment banker from 2019-2021, so you could say I know a thing or two about SPACs. The joke when discussing any fundraising options with clients during this time was to just shout ‘SPAC!’ and collect your fee.

My readers from Money Stuff know a whole lot more, of course, thanks to Mr. Levine.

And of course some retail investor exploitation.

How would I go about throwing my hat in the ring for This newsletter is looking for a 'Chief Visionary Officer'?

Do a Zoom ? A phone call ? (Whatever that is). Operations@nyccia.com